Let’s be honest: most of us reach the end of the month asking ourselves, “Where did all my money go?” With rising expenses and inflation, building savings can feel impossible or like it requires sacrificing too much of our daily needs.

The truth is, saving in 2025 is completely different. You don’t have to deprive yourself or wait for a higher income. What you need is a smarter way to manage your money and digital tools that help you save step by step, according to your lifestyle and financial situation.

In this article, we’ll explore how to start saving properly, build real savings, and manage your finances with a modern, fintech-friendly approach that’s simple, smart, and realistic.

Organize Your Money: Smart Money Management Techniques

The first step in your savings journey is organizing your income and expenses. Many of us spend without tracking where our money goes, making saving a challenge.

Here’s how to start:

- Review your monthly income and record it using a spreadsheet or budgeting app.

- Identify essential expenses: food, housing, utilities, etc.

- Track discretionary spending: leisure, shopping, and clothing.

- Allocate a portion of your income to savings right away.

A proven rule is the 50/30/20 rule: 50% for essentials, 30% for wants, and 20% for savings, investments, or debt repayment.

Try budgeting for a full month and see how much you can save, even just 10% at first.

Learn more about the 50/30/20 rule here.

Set Financial Goals: Turn Saving into a Clear Objective

Whether you’re saving for an emergency fund, travel, a new car, or an investment, setting goals helps you stay focused and reach them faster:

- Short-term: weeks to months, e.g., saving a specific amount quickly.

- Medium-term: 1–2 years, e.g., a down payment on a car or setting up a new apartment.

- Long-term: years, e.g., investing in property or retirement savings.

Ask yourself: Why am I saving, and when do I want to reach it? Clear goals transform savings from a vague number in your account into a structured plan.

Investment Strategies for Beginners

Investing is one of the best ways to grow your savings over time. Your money doesn’t just sit, it earns returns or interest, gradually increasing over the years. The best part? You don’t need a huge amount of money or financial experience to start. You just need the right tools and consistency.

Popular Beginner Investment Options:

1. High-interest savings accounts:

Programs like Money Fellows’ savings plans, bank savings accounts, or certificates. Ideal for multiple goals and safe, steady growth.

2. Mutual funds:

Professionally managed funds pool investors’ money into stocks, bonds, or other financial instruments. No daily monitoring is needed, allowing gradual savings growth and passive income.

3. Investment certificates:

Similar to savings accounts but with guaranteed returns over a fixed term, ranging from short to long-term (up to 5 years). Flexible options allow you to access funds if needed, offering safe and worry-free savings.

Choose based on your financial goal, timeline, and risk tolerance. For example, if nearing retirement, safe instruments like certificates and savings accounts are ideal, while mutual funds suit long-term growth.

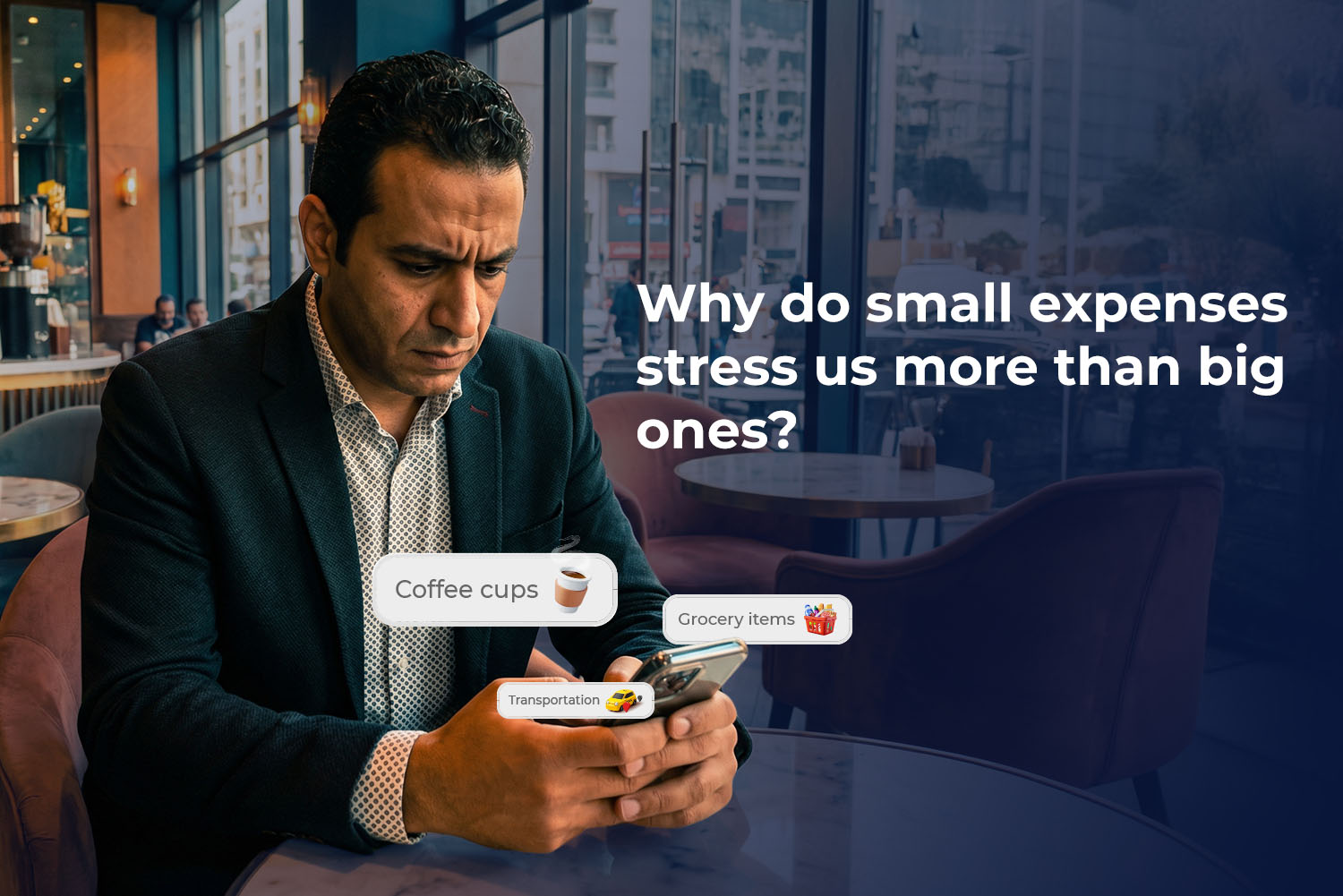

6 Smart Tips to Save Money Daily

Wondering “How can I save money day-to-day?” The answer often lies in small, unnoticed expenses that quietly drain your budget.

It’s not about cutting out life’s joys; it’s about making smarter choices: coffee, dining out, and unused subscriptions may seem small, but they add up fast. Focus on recurring spending habits and cut unnecessary costs.

Even small, consistent savings accumulate into real savings over time.

1. Grocery Shopping Tips

Supermarkets are one of the easiest places to overspend. A few simple adjustments can save a lot:

- Plan meals based on what’s already in your fridge.

- Check weekly store offers before making your shopping list.

- Stick to your list to avoid impulse buys.

- Use online grocery apps to track total spending.

- Buy frequently used items in bulk when possible.