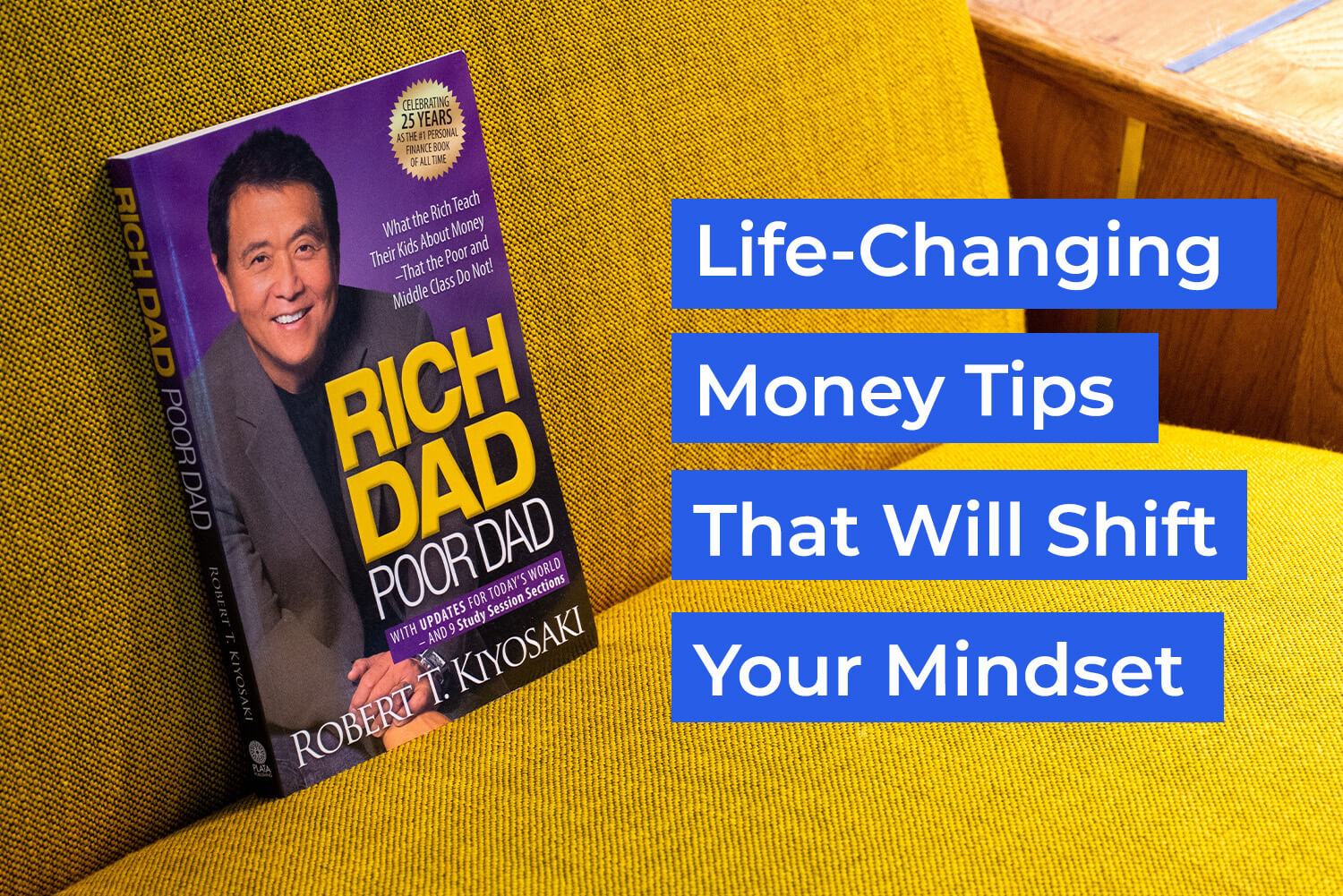

Many people believe that living debt-free is the ultimate financial goal, and while that’s not entirely wrong, the truth is that not all debt is bad. Some types of debt can help you improve your financial situation, like a mortgage that allows you to own a home instead of paying rent for life.

On the flip side, there are harmful debts, like high-interest credit cards, that can drain your finances without offering any long-term value. These are the kinds of debts that can spiral out of control if not managed properly.

If you’re feeling overwhelmed by debt and don’t know where to start, the first step is to understand your debt types and create a plan to manage them. That’s exactly what we’ll cover in this article.

What is Debt Management?

Debt management simply means having a clear plan to repay your debts—whether it’s credit cards, personal loans, or unsecured debt (loans without collateral). A solid debt management plan typically includes:

- How much do you owe?

- Who do you owe it to?

- How and when do you make your payments?

These plans are usually designed for unsecured debt, such as credit cards and personal loans, and they’re a great step toward financial stability.

Good Debt vs Bad Debt

Not all debt is created equal. Some debt helps you build wealth or increase your income. Others lose value over time and add financial pressure.

1. Good Debt

Good debt is an investment in your future. It can help you earn more money or acquire valuable assets.

Examples include:

- Education Loans: Investing in your education can unlock better job opportunities and higher income.

- Business Loans: Launching your own business involves risk, but it could change your life if done wisely.

- Mortgage Loans: Buying property builds equity and can appreciate over time.