In today’s world, with prices constantly rising and expenses increasing, saving money can feel like an impossible task. But saving doesn’t have to be stressful. With the right tools, it can be smart, simple, and secure. That’s exactly what Money Fellows offers, a smarter way to save through digital money circles straight from your phone.

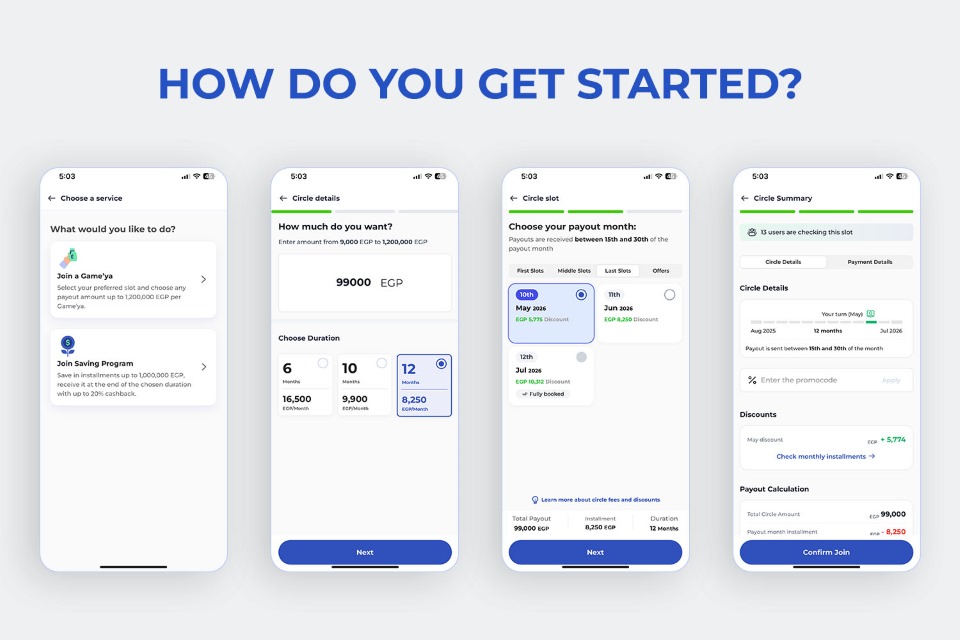

In this guide, we’ll walk you through how Money Fellows Circles work and how to join your first one, step by step.

What Is the Money Fellows App?

Money Fellows is a financial app that makes group saving in Egypt easy, secure, and accessible for everyone. It transforms the traditional idea of a "money circle" or “ROSCA” into a digital money circle that helps you achieve your financial goals, whether you're saving for a car, a new phone, travel, or even a private business idea.

Through the app, you join a digital money circle with other verified users. Choose the payout slot that works best for you, pay monthly installments online, and receive your payout on time, with no interest and no paperwork.

If you want to learn more about Money Fellows, check out this article: Your Complete Guide to Money Fellows App.

Join a circle now and get 25% off your first two installments when you choose one of the first three payout slots. Start here.

Why Choose Money Fellows for Planning, Saving, and Spending?

- Trustworthy: Backed by the Central Bank of Egypt and Banque Misr, your money is handled through licensed, secure financial channels.

- Privacy: Your financial goals and plans stay completely confidential, only you can see your circle activity.

- Flexibility: Choose the payout timing that fits your needs, manage your circle choices, and save at your own pace, on your terms.

That’s why Money Fellows is perfect for all kinds of financial plans, from school fees and wedding costs to investments and personal milestones.

Traditional Gam’eya vs. Money Fellows Circles

| Category | Traditional Gam’eya | Money Fellows Circles |

|---|---|---|

| Management | Manual and often chaotic. | App-managed, automated, and fully digital. |

| Security | Based on personal trust only. | Licensed and supervised by the Central Bank of Egypt, in partnership with Banque Misr. |

| Flexibility | Limited options for timing and payout. | Choose your slot, amount, and duration with full flexibility. |

| Privacy | Details shared among group members. | Full confidentiality on your slot and payout. |

| Tracking | Requires calls, messages, and follow-ups. | All details are updated live through the app. |