Many people in Egypt work hard, earn a steady income, and manage their money based on their circumstances. Yet when it comes time to apply for a financial service, installments, a credit card, loans, or even simple financing, the answer is often the same: your I-Score is not eligible.

What’s surprising is that this usually has nothing to do with income level or how often you spend. It’s all about financial behavior.

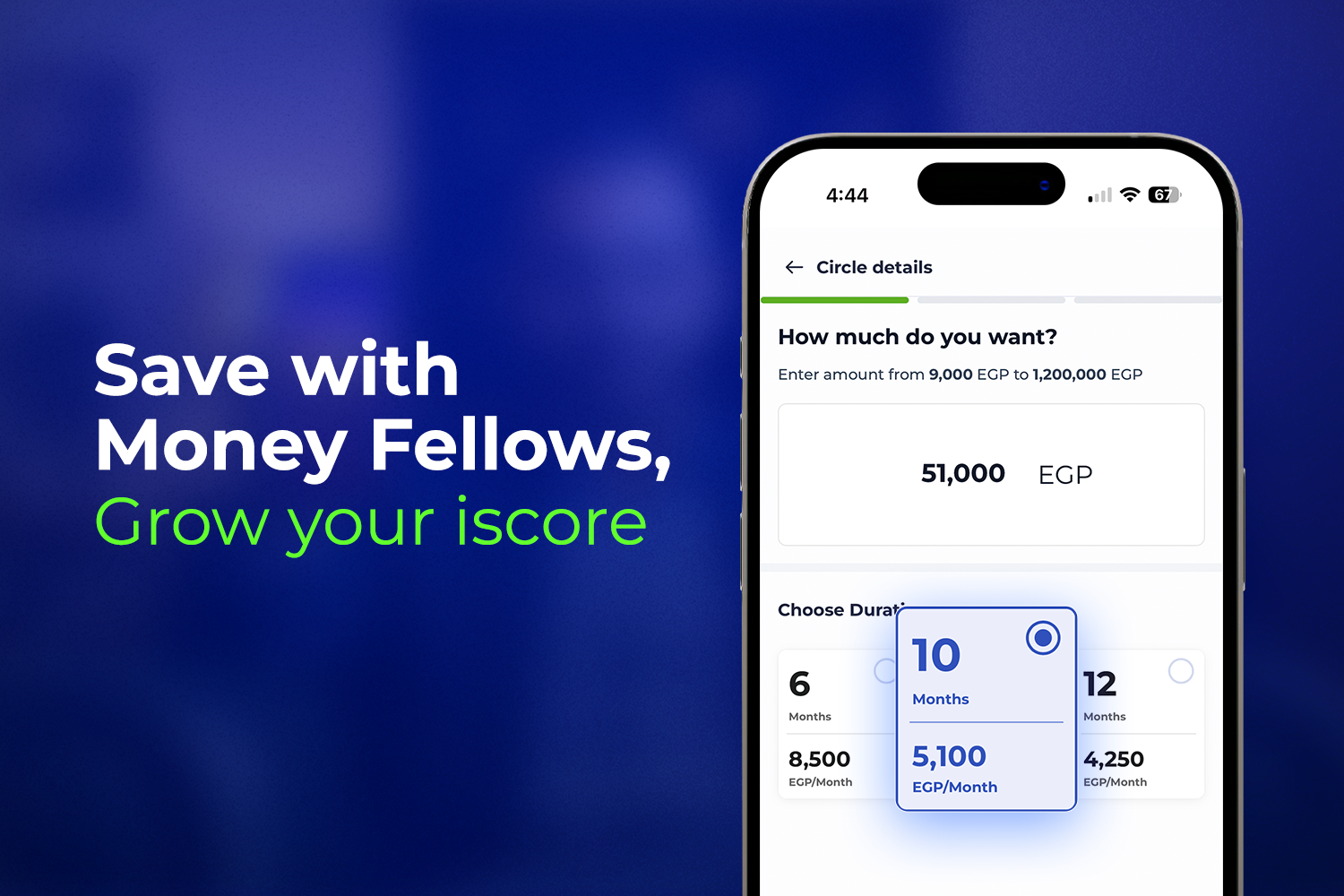

Your I-Score (credit score) has become one of the most important factors determining your financial opportunities in Egypt, even if you’re not fully aware of it. Every late payment, unclear obligation, or unplanned financial decision directly affects how banks and financial institutions evaluate you.

And here’s the key insight: improving your I-Score doesn’t start at the bank; it starts in your daily life. From how you spend, how you commit, and how you manage your money throughout the month.

The good news? You don’t need to be a financial expert, deprive yourself, or completely change your lifestyle. You just need to understand how to deal with money in a smarter, more sustainable way. In this article, we’ll break down: What the I-Score really is and why it matters, practical habits that help improve your I-Score, and how smart financial tools can help you improve it gradually and safely

What Is the I-Score?

The I-Score, also known as your credit score, reflects your real financial behavior, not just your salary or job title. It’s a combined picture of how you deal with financial obligations over time.

Your credit score in Egypt mainly answers questions like:

- Do you pay on time? Whether it’s installments, credit cards, or any financial obligation, payment history is one of the strongest factors that raise or lower your I-Score.

- How much debt do you carry compared to your income? Debt itself isn’t the problem. Poorly managed or excessive debt is. Balanced commitments show financial stability.

- Is your financial behavior consistent or random? Stable spending, saving, and repayment habits build trust with banks and lenders.

In Egypt, the I-Score is essential for almost any formal financial transaction. The higher your score, the better your chances of:

- Getting loans with better terms.

- Being approved for installment plans.

- Issuing credit cards.

- Accessing financial services with fewer rejections.

7 Smart Habits That Improve Your I-Score

Improving your credit score doesn’t require big financial moves. Most of the impact comes from small daily habits repeated consistently. These habits shape your financial profile over time and directly affect your I-Score:

1. Never Miss a Payment Due Date

If there’s one golden rule for improving your I-Score in Egypt, it’s paying on time. Your payment history is one of the strongest contributors to your credit score. Even small delays can hurt your score, while consistent on-time payments improve it steadily.

To avoid missing due dates:

- Activate autopay whenever possible.

- Enable payment reminders from banks or service providers.

- Create your own reminder system using your calendar or email.

Choose the method that works best for you and stick to it. Consistency is key.

2. Keep Your Credit Usage Low

Paying on time isn’t enough on its own. How much of your available credit you use also matters. A simple rule: try not to use more than 30% of your credit limit.

For example, if your credit card limit is EGP 100,000, aim to keep your balance below EGP 30,000.

This is known as credit utilization, and it plays a major role in calculating your I-Score. Lower utilization signals financial control and stability.