Read More

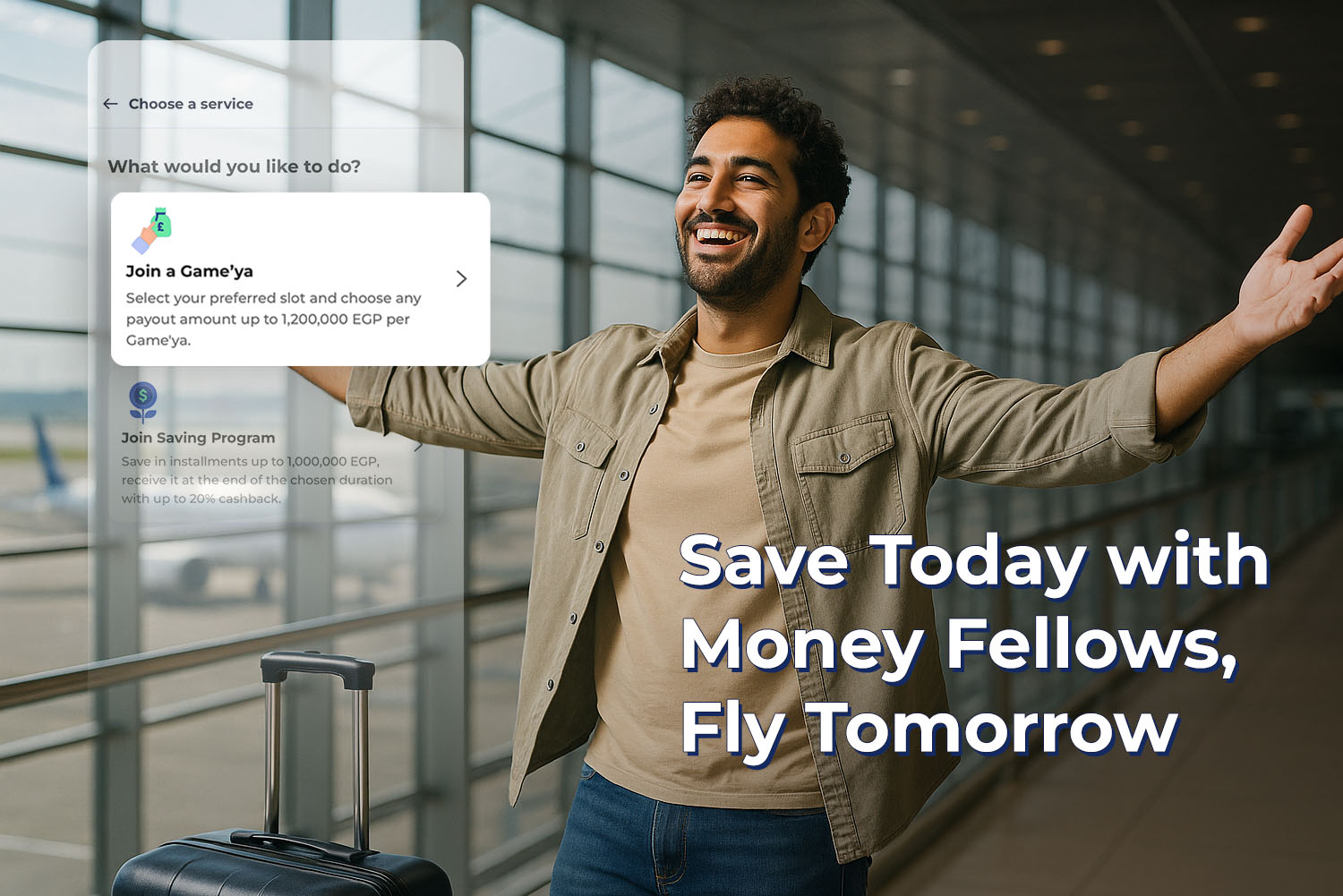

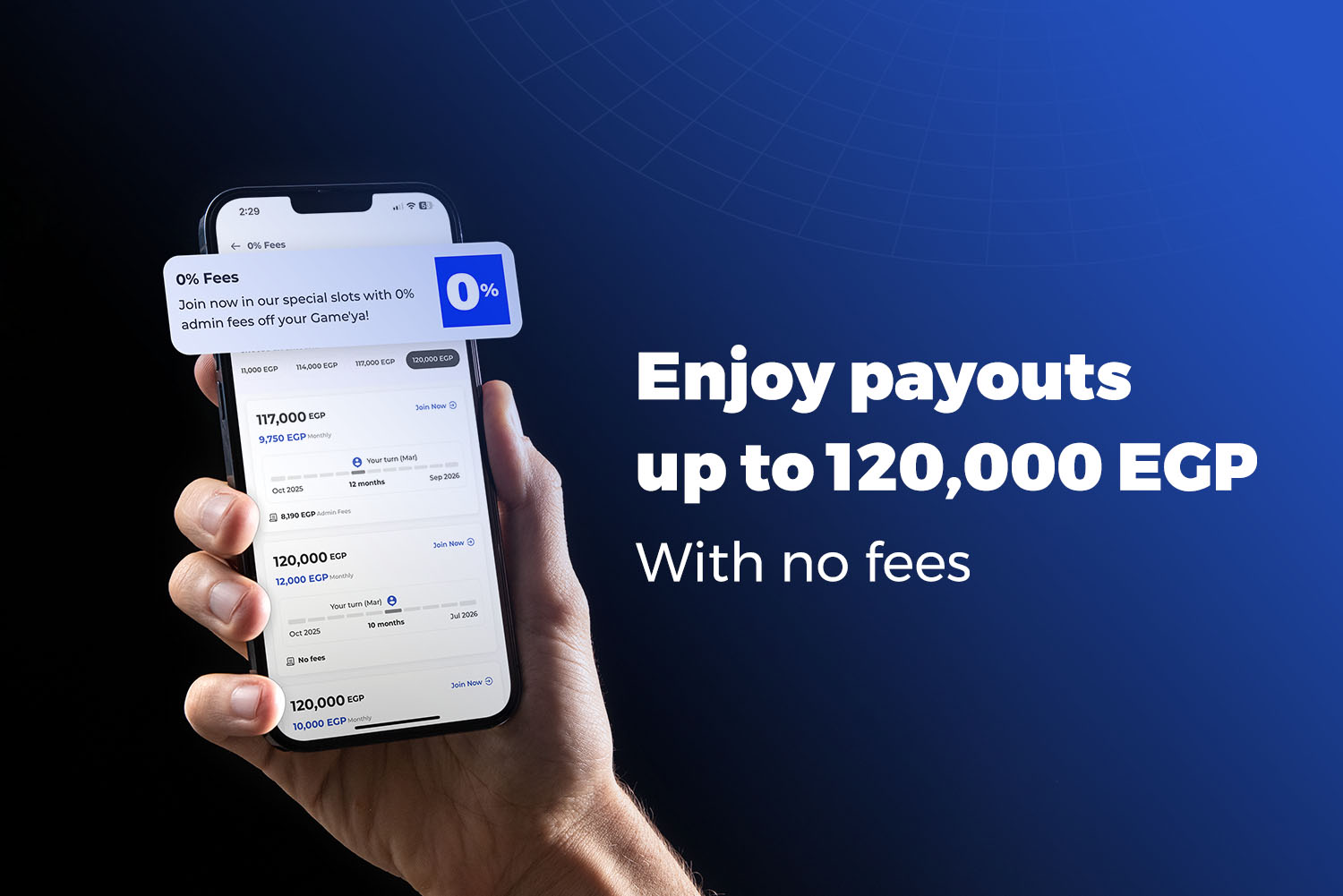

Who doesn’t want a smart, effective, and easy way to manage their money and achieve financial freedom? We all do, right?! After searching the market and exploring various apps, Money Fellows emerges as the perfect solution for all of us! With flexible Money Circles (known as game’yat) offered by the app, you can join a circle with others and either start saving or receive a large amount that helps you achieve your goals.

- 10 Dec 2024

Read More

Startups have become a driving force for innovation and growth in today's world. Known for their bold ideas and solutions, these small entities transform traditional problems into modern solutions that cater to new generations. Startups stand at the forefront of ventures that capture the attention of both investors and consumers.

- 03 May 2024

Read More

Did you know that any personal loan can impact your I-Score in different ways, both positive and negative? Taking out a personal loan doesn’t necessarily harm your I-Score. However, it may lower your credit score temporarily, making it harder to take out additional loans until you've repaid the existing one.

- 01 Sep 2024

Read More

You might have asked yourself several times, "What is the meaning and importance of investment?" While the answer can be detailed, the most significant advantage of investing is financial stability. It's widely understood that you can earn money in two ways: working for a company or running your own business.

- 04 Sep 2024

Read More

We all know the stress that hits when unexpected money issues arise, like your car breaking down or a hefty bill showing up just when you least expect it. In those moments, you might find yourself asking, “What am I going to do? How will I pay this?” But if you can treat these situations as mere annoyances rather than sources of anxiety, it means you’re well on your way to financial freedom!

- 05 Sep 2024

Read More

When it comes to money, our thoughts often vary depending on our goals and financial plans. In particular, when discussing finances, it's essential to talk about investing and saving and understand the difference between the two. You might also wonder about the best ways to save money or whether it's better to invest instead. Are there significant differences between investing and saving?

- 05 Sep 2024

Read More

We often find ourselves torn between enjoying the money we have right now and securing our financial future. Imagine this: you’ve got a good amount of money. Do you use it for that dream trip to Europe you’ve been thinking about for years, or do you invest it wisely to ensure a stable future? Of course, the answer will vary from person to person, and there’s no one-size-fits-all solution!

- 08 Sep 2024

Read More

Who doesn’t know that saving money is one of the essential steps to building wealth and achieving financial security? But what most people don’t realize is that saving has more than just financial benefits, it can also bring peace of mind by reducing money-related stress, allowing you to enjoy life more.

- 09 Sep 2024

Read More

Investing can be one of the most complex financial concepts, but it is also one of the key pillars for financial independence and wealth-building. Understanding the various investment terms may seem overwhelming at first, but once you get the hang of it, you'll begin to feel more comfortable and confident on your investment journey.

- 11 Sep 2024

Read More

With inflation on the rise and causing various challenges, many investors are seeking alternative investment options, such as gold, to preserve the value of their portfolios. While investing in gold does come with its own set of challenges due to the variety of available options, it offers unique benefits to many people.

- 19 Sep 2024

Read More

With many people aspiring to enter the world of investment and grow their wealth, securing initial capital is the first and most important step. In this article, we will discuss the best strategies for obtaining initial capital for investment across different fields such as stocks, bonds, real estate, cryptocurrency, gold, and technology. We'll focus on practical methods that can help you build the necessary funds to start your investment journey.

- 10 Jun 2024

Read More

With rapid technological advancements, financial services in Egypt are undergoing a major transformation, contributing to enhanced service quality and greater financial inclusion for individuals and businesses. This article explores how technology is driving improvements in financial services in Egypt, and how these developments are supporting economic growth and providing innovative financial solutions.

- 29 Jun 2024

Read More

Investing is a powerful way to achieve financial freedom and achieve your dreams. But before diving into the world of investing, it's essential to have a clear plan and well-defined financial goals. Setting these goals helps you prioritize and understand the right path to take while also allowing you to measure your progress over time.

- 30 Sep 2024

Read More

Financial stress is a reality for many people. However, when not managed properly, it can become a hidden source of various mental and physical issues. While discussing financial stress and ways to avoid it, it's important to focus on young people, helping them develop a healthy relationship with money and learn personal finance and money management concepts.

- 06 Oct 2024

Read More

With the widespread availability of credit cards and financial facilities, it's become common to pay for purchases—even small ones—using a credit card. While paying with a credit card can be incredibly convenient and can even save you in certain situations, using credit cards can have both good and bad reasons.

- 10 Oct 2024

Read More

Enhancing your I-Score is a crucial step towards achieving financial stability and gaining access to better financing opportunities. In Egypt, your I-Score plays a significant role in determining your ability to obtain loans and other financial services. This article provides practical tips for improving your I-Score in Egypt, making it easier for you to achieve your financial goals.

- 29 Jun 2024

Read More

Today, loans have become essential to many individuals' and businesses' financial lives. With the advancement of technology, online loans have emerged as an alternative to traditional bank loans. This article will provide a comprehensive comparison between bank loans and online loans, focusing on the pros and cons of each to help you make the best decision for your financial needs.

- 07 Jul 2024

Read More

Money Fellows is a digital platform offering online money circles (known as "Game’yat" in Arabic), designed to help users save and invest safely and efficiently. By modernizing the traditional concept of money circles, Money Fellows ensures security, transparency, and commitment for all its users. Additionally, the platform allows users to manage their finances and choose the money circles that suit their needs.

- 09 Dec 2024

Read More

Are you looking to grow your savings? Investing in investment funds could be a smart move if you're exploring options to make your money work for you. Over recent years, these funds have gained immense popularity as one of the most accessible financial tools. But before making any decisions, it's essential to understand how they work and assess whether they align with your financial goals.

- 08 Dec 2024

Read More

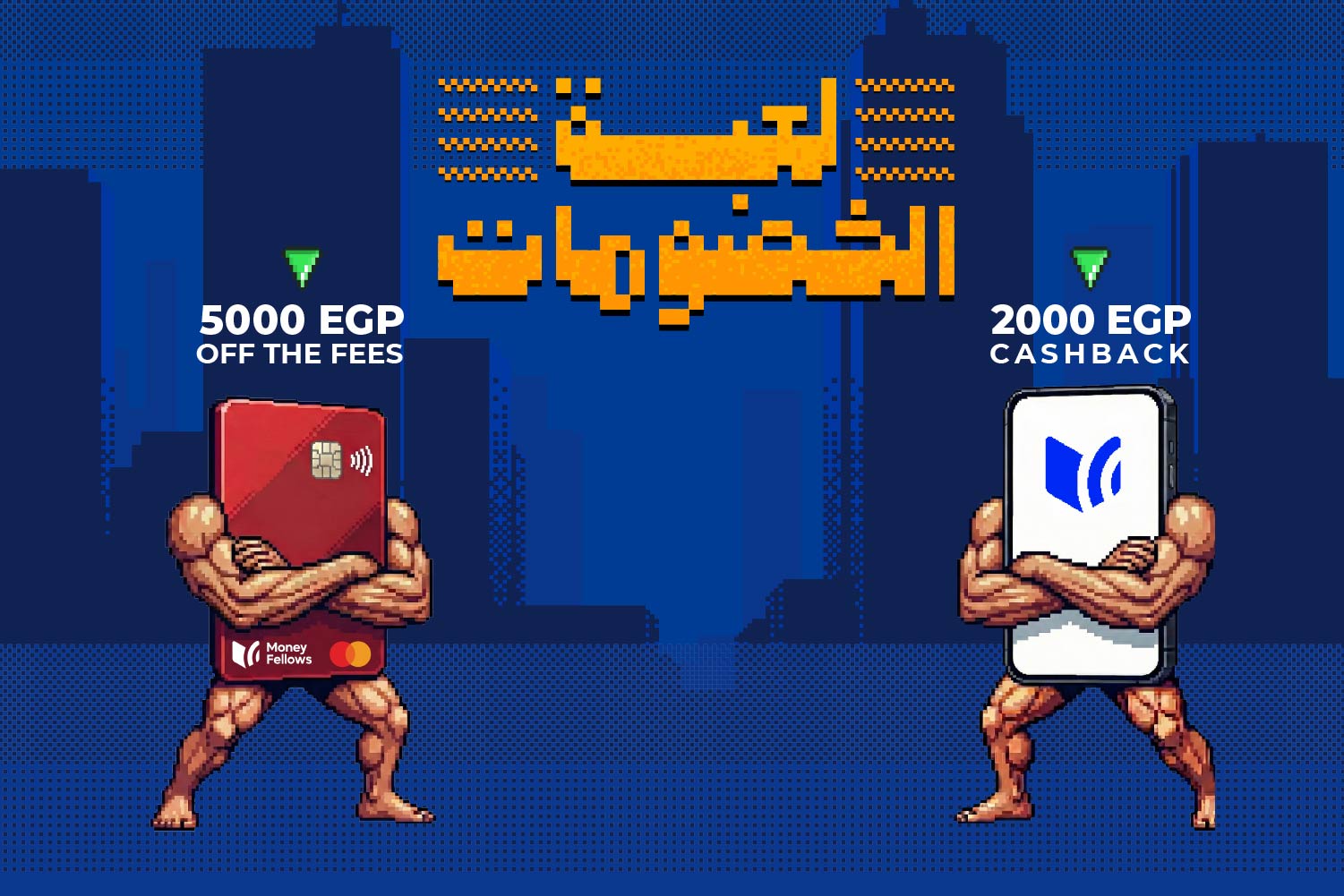

Looking for a seamless way to manage your finances? Money Fellows is excited to launch its new Prepaid Card, designed to help you handle your money circles effortlessly. With this card, you can pay and receive your payouts with zero service fees, enjoy exclusive discounts from our merchants' network, and benefit from 5% cashback on every transaction up to 100 EGP (for a limited time), plus many more features!

- 09 Jan 2025

Read More

Inflation has become a common topic of discussion over the past few years, and understanding its effects on your finances is more important than ever. Simply put, inflation refers to the general rise in prices over time, which results in the decreased purchasing power of money. Inflation rates indicate how much value investments lose and how much prices increase over time.

- 12 Jan 2025

Read More

Retirement planning is one of the most important financial decisions anyone will make in their lifetime. While you're working, it’s essential to save consistently to prepare for life after work and to meet specific goals at various stages of your life. According to the National Institute of Retirement Security, over 60% of households led by individuals aged 55-64 have less than their annual income saved for retirement.

- 13 Jan 2025

Read More

Gold has long been regarded as one of the safest investment options, particularly during economic crises and global market fluctuations. Its enduring demand and limited supply make it a reliable choice. Many investors view gold as an excellent way to diversify their portfolios, as its performance is generally uncorrelated with that of other asset classes, such as stocks or currencies.

- 14 Jan 2025

Read More

Savings are an essential foundation for any financial plan, offering numerous benefits that help with short-term stability and long-term security. The advantage of saving isn’t just that it helps you have money for emergencies; it also opens doors for investment, reducing debt, and achieving financial independence. Having a savings buffer provides peace of mind and prepares you for unexpected expenses. It also helps you reach major goals such as buying a home, funding education or planning for retirement.

- 15 Jan 2025

Read More

One of the most convenient options on the market right now is the Money Fellows Prepaid Card. This card not only makes payments and shopping easier, but it also keeps your security intact and protects you from fraud. Since you don’t need a bank account to use it, you simply load the card using different methods and start using it immediately.

- 10 Feb 2025

Read More

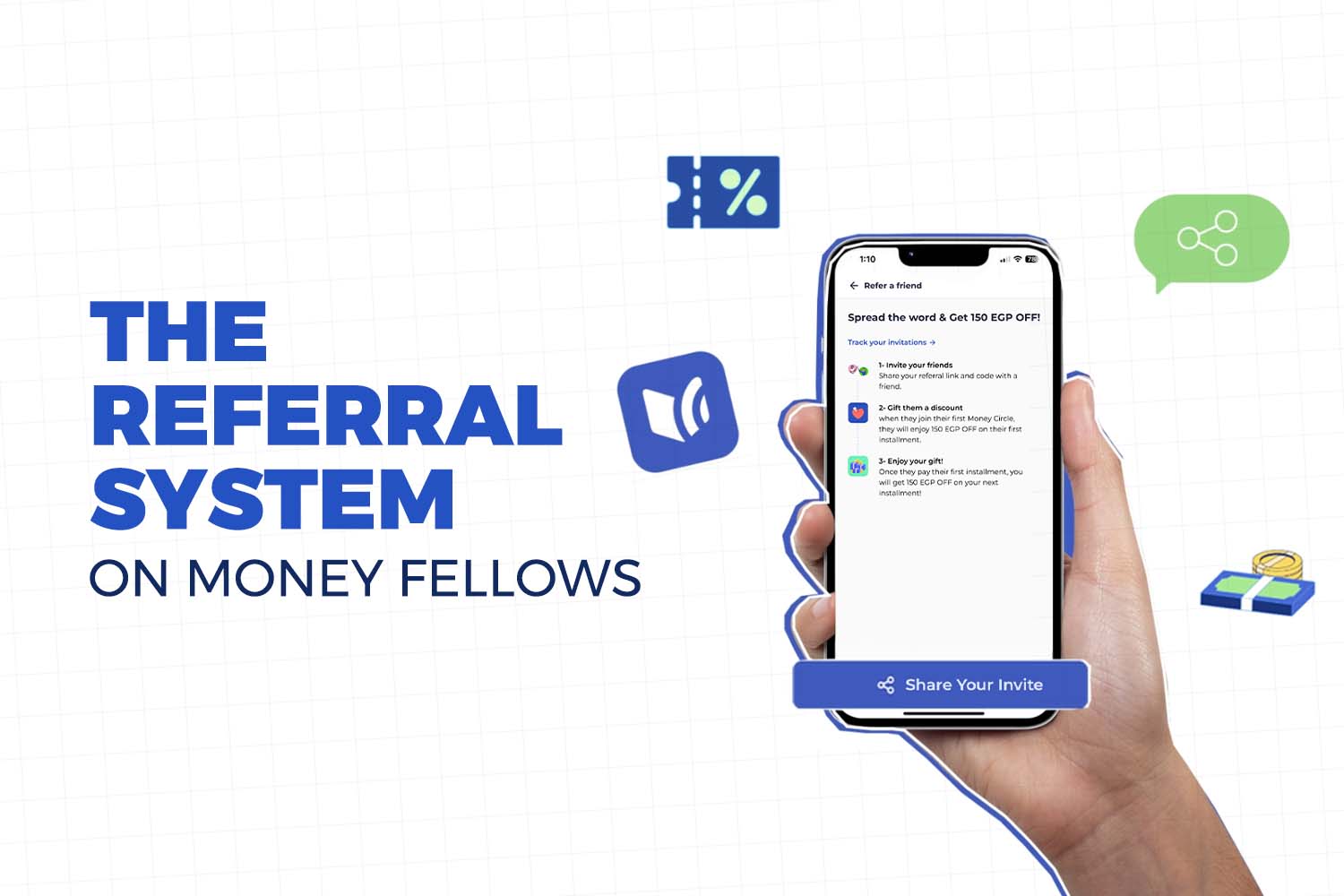

Who doesn’t want to earn extra income and explore innovative ways to increase their financial stability? In today's digital era, technology has revolutionized how we manage money, making financial solutions more accessible and efficient. One of the leading platforms in this space is Money Fellows, offering a secure and smart way to manage finances and achieve financial independence.

- 16 Feb 2025

Read More

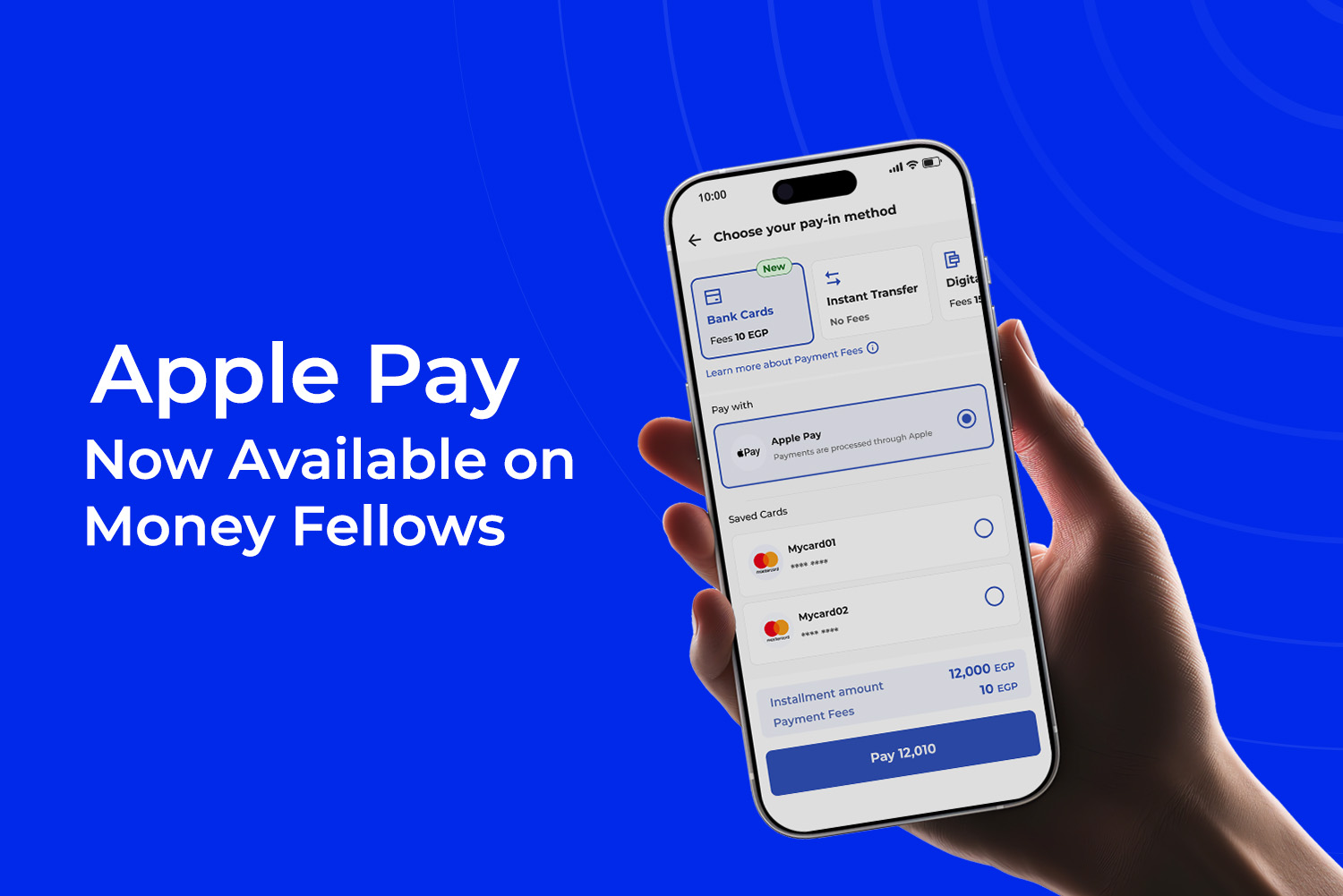

Money Fellows, Egypt's #1 app for digital money circles, is making another breakthrough in financial innovation by adding Apple Pay as a new payment method. In partnership with Paymob Payment Gateway and in collaboration with Banque Misr, the official banking partner, this move offers users a faster, easier, and more secure payment experience than ever before!

- 15 Jan 2025

Read More

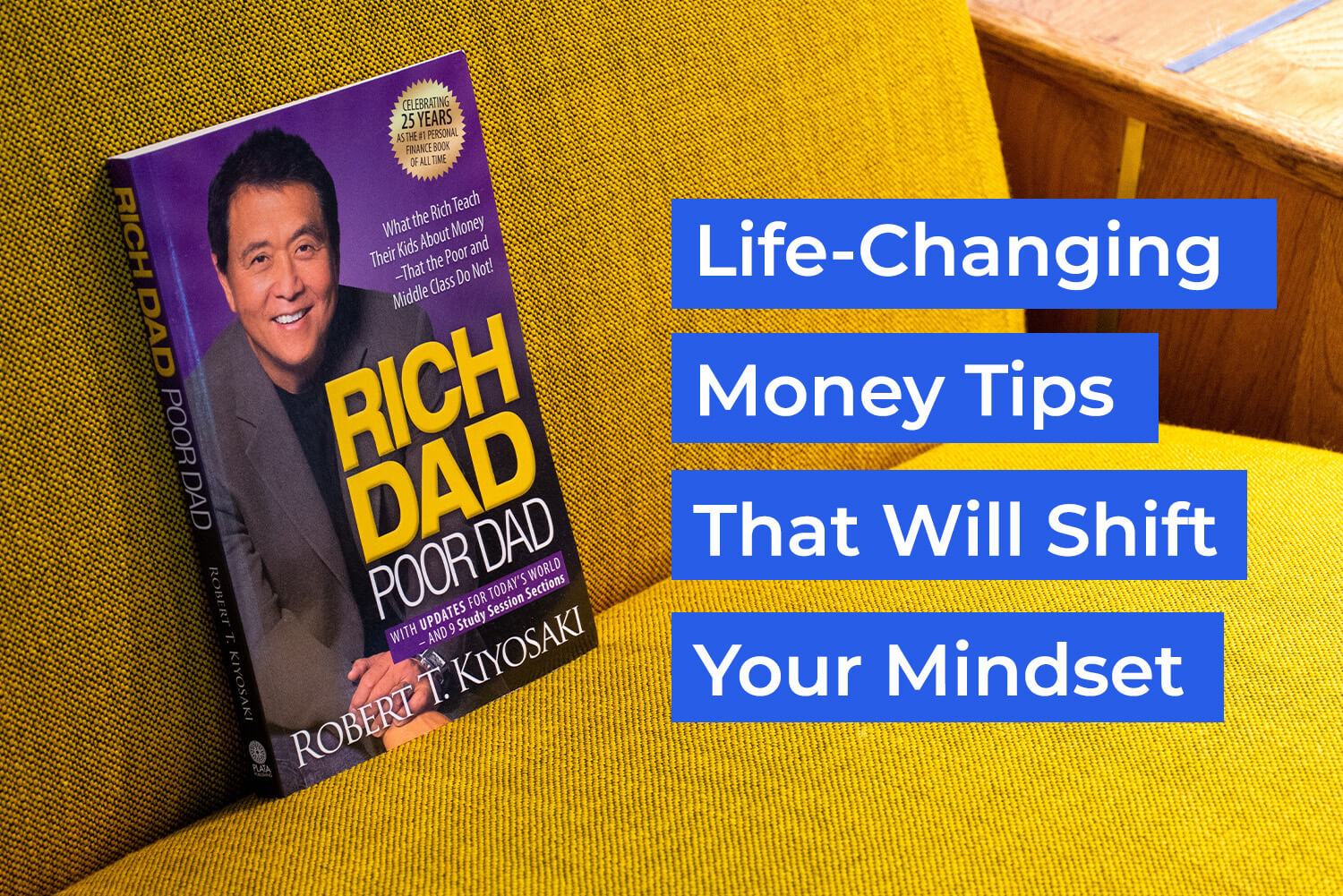

We all search for ways to achieve financial freedom, but few know how to start and keep going the right way. Rich Dad Poor Dad by Robert Kiyosaki is a practical and unique guide that challenges how we view money and investment. This book isn't just about traditional financial advice, it offers real-life lessons on how to think like the wealthy and build assets that secure your future without relying solely on a paycheck.

- 06 Apr 2025

Read More

There’s a simple and effective method that can change the way you handle your money: The 50/30/20 budgeting rule. You don’t need complicated calculations or fancy tools. All it takes is to divide your income into three clear categories—each with a purpose that helps bring structure to your financial life.

- 16 Apr 2025

Read More

Creating a personal budget might sound intimidating, but it’s simply about gaining control over your finances and spending habits. A solid budget gives you the freedom to spend comfortably, without constantly worrying about running out of money before your next paycheck. Whether you’re trying to manage debt, save money, or just keep track of your expenses, budgeting is the first step to building better money habits.

- 17 Apr 2025

Read More

Many people believe that living debt-free is the ultimate financial goal, and while that’s not entirely wrong, the truth is that not all debt is bad. Some types of debt can help you improve your financial situation, like a mortgage that allows you to own a home instead of paying rent for life.

- 27 Apr 2025

Read More

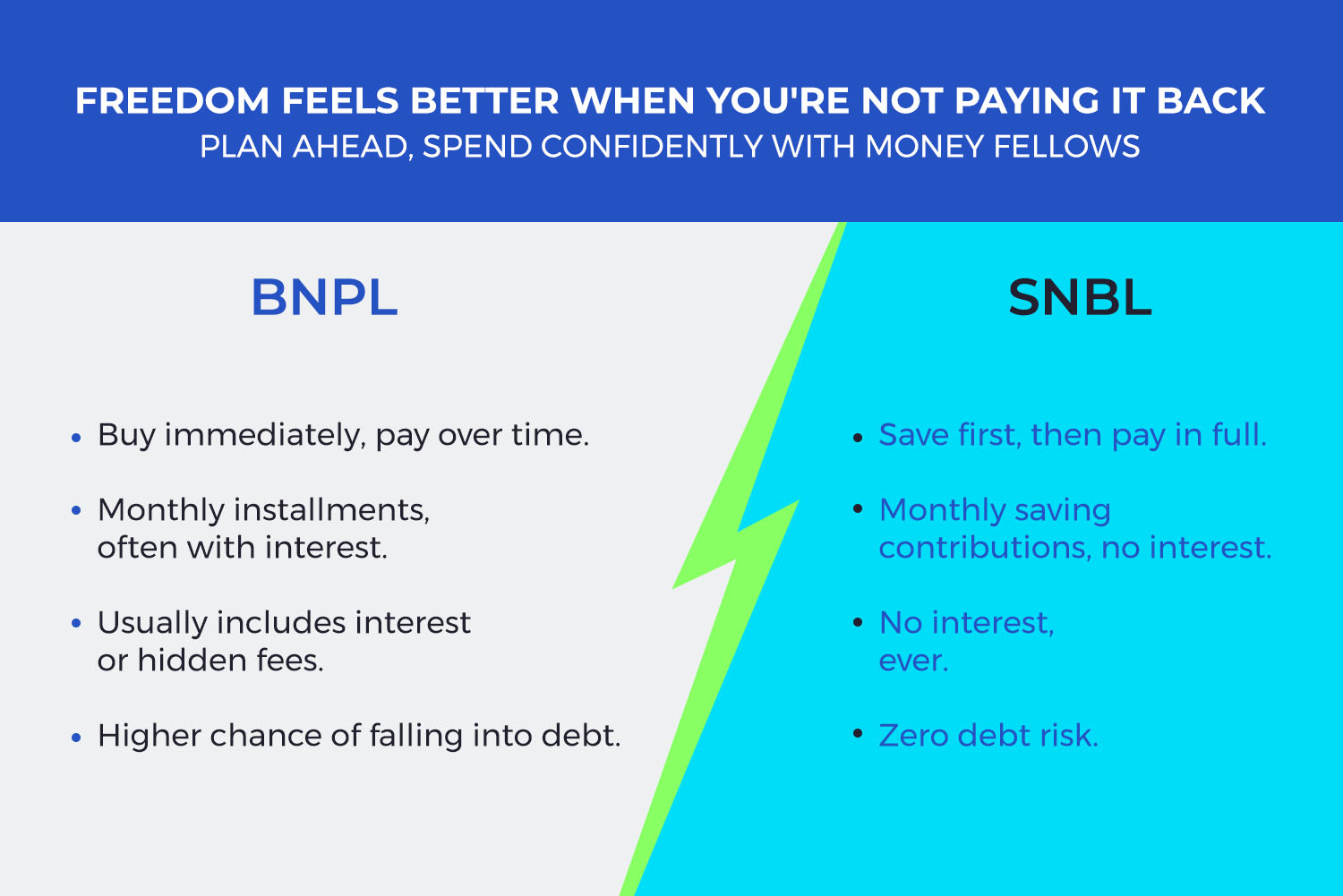

We all know the feeling. A new month begins, and you’re fired up with a fresh plan: “This time, I’m going to save. I’ll finally start working on that dream trip or get the phone I’ve been wanting for months.” But as soon as your paycheck lands, it vanishes—bills, unexpected expenses, and endless commitments.

- 01 Jul 2025

Read More

In today’s world, with prices constantly rising and expenses increasing, saving money can feel like an impossible task. But saving doesn’t have to be stressful. With the right tools, it can be smart, simple, and secure. That’s exactly what Money Fellows offers: a smarter way to save through digital money circles straight from your phone.

- 21 Jul 2025

Read More

Black Friday has become one of the most anticipated shopping events of the year. Huge Black Friday deals, jaw-dropping discounts, and prices that make you feel like you must buy now before the offers disappear. But here’s the truth: while it’s exciting, it can also be one of the most financially stressful days.

- 10 Aug 2025

Read More

Who hasn’t dreamed of buying their own car, or finally replacing that old one that’s draining money on endless repairs? Whether it’s for easier daily commutes, weekend road trips with friends, or the satisfaction of achieving a big life milestone, owning a car is a dream we all share.

- 17 Aug 2025

Read More

Today, there are plenty of easy and affordable ways to invest in Egypt, starting with as little as 500 EGP, or even less. From gold investments and government savings certificates to treasury bills, digital investment apps, and practical savings tools like the Money Fellows App, anyone can begin their journey.

- 20 Aug 2025

Read More

In today’s fast-paced world, leaving your money idle without a clear plan is no longer an option. Prices are rising every day, expenses keep increasing, and your dreams are getting bigger. That’s why smart investment is not a luxury anymore, it’s a necessity for anyone who wants a secure financial future and a better life.

- 07 Sep 2025

Read More

The end of the year is always a special time. Some people reflect on what they’ve achieved, others start planning for the year ahead. In between, there are countless financial commitments: household expenses, school and university fees, holiday shopping, or even a short getaway before the new year.

- 06 Sep 2025

Read More

We all have financial goals we dream of reaching. Some people want to save for their wedding, furnish a new apartment, or plan an exciting trip abroad. Others focus on long-term goals like buying a home or investing in a project. At the same time, there are unavoidable responsibilities like school fees, household appliances, or everyday expenses that never wait.

- 11 Sep 2025

Read More

Everyone has dreams they want to achieve and financial commitments that keep piling up. Some people want to save for travel, others are preparing for their wedding, investing in gold, paying school fees, or renovating their home. The challenge is that these goals overlap, leaving you uncertain about where to begin.

- 05 Oct 2025

Read More

This year, Money Fellows has prepared the biggest October Discounts Campaign. These special offers are designed to fit your upcoming needs, whether you want to take advantage of Christmas sales, start saving early for Ramadan, or get ready for Eid expenses. With one app, you’ll find smart financial solutions that help you plan, save, and win.

- 09 Oct 2025

Read More

October is the month of smart saving with Money Fellows. With three unique saving plans designed to match your lifestyle and goals, you can easily choose what fits you best, whether you’re saving for a big dream, planning steadily, or want a fast win with a short-term circle and a quick payout.

- 15 Oct 2025

Read More

These days, everyone is thinking about how to increase their income in Egypt, especially with prices rising and expenses piling up. Whether you’re a student, an employee, or just starting your career, you’ve probably asked yourself: How can I make extra money without leaving my main job?

- 27 Oct 2025

Read More

If you’re interested in money management, digital saving apps, or simply want to make smarter financial decisions, this article is for you. We’ll walk you through how AI can help you take control of your money, how platforms like Money Fellows make saving simpler, and how to bring both together in your daily financial life, without the complexity.

- 06 Nov 2025

Read More

Every year, we all wait for Black Friday offers, that time in November when we finally buy everything we’ve been saving for: a new phone, winter outfits, home essentials, or even appliances. But here’s the real question, why do we always end the month regretting how much we spent, especially when Ramadan and Eid are just around the corner?

- 10 Nov 2025

Read More

Black Friday is no longer just a one-day sale, it has become a full shopping season packed with opportunities that can completely reshape your buying plans for the entire year. With overwhelming deals and intense competition between platforms, it’s easy to get confused or miss out on buying what you actually need at the right price.

- 13 Nov 2025

Read More

Investing in gold doesn’t have to mean buying a full gold bar or spending a huge amount all at once. Now, you can start saving gold the smart way from your phone, by joining a gold circle with Money Fellows. It’s 100% interest-free and fully flexible based on your income and lifestyle.

- 19 Nov 2025

Read More

This guide will walk you through the essentials of setting clear retirement goals, reviewing your current financial situation, and organizing your savings and expenses in a smart, practical way. You’ll also learn how to plan for future income sources, create a withdrawal strategy, and make sure you have steady financial support for the lifestyle you want during retirement.

- 24 Nov 2025

Read More

December isn’t just a month of rest and year-end reflection; it’s also a whirlwind of thoughts, expenses, and goals. From preparing for Ramadan in advance, planning a Umrah trip, managing school fees, setting up your home, or organizing a mid-year vacation, the month flies by with endless responsibilities.

- 11 Dec 2025

Read More

Installments look easy at the start, but often become heavier, more stressful, and much more expensive in the end. That’s why more people in Egypt are now looking for ways to buy a new phone comfortably, without commitments, and without feeling like half their salary disappears into monthly installment payments with high interest rates.

- 14 Dec 2025

Read More

Credit cards can be a great solution for certain purchases if you have strong financial discipline and full control over your spending. But if you struggle with credit card debt, high interest rates, and late payment fees, it may be smarter to stop using credit cards until you get your finances back on track.

- 16 Dec 2025

Read More

At a time when every Egyptian pound matters, and its value is constantly affected by inflation and market changes, investing in Egypt is no longer a luxury; it’s a necessity. Many people are looking for ways to protect their savings or grow their money, even if gradually. That’s why investment certificates in Egypt are often seen as a safe and reliable option.

- 21 Dec 2025

Read More

What’s surprising is that the problem isn’t always overspending. Many people today track every single pound, check their balance multiple times a day, and still feel anxious. You go through the entire month on edge, afraid to spend too much, but also afraid to save and “be too hard on yourself.”

- 12 Jan 2026

Read More

Your I-Score (credit score) has become one of the most important factors determining your financial opportunities in Egypt, even if you’re not fully aware of it. Every late payment, unclear obligation, or unplanned financial decision directly affects how banks and financial institutions evaluate you.

- 19 Jan 2026